The DB pensions landscape

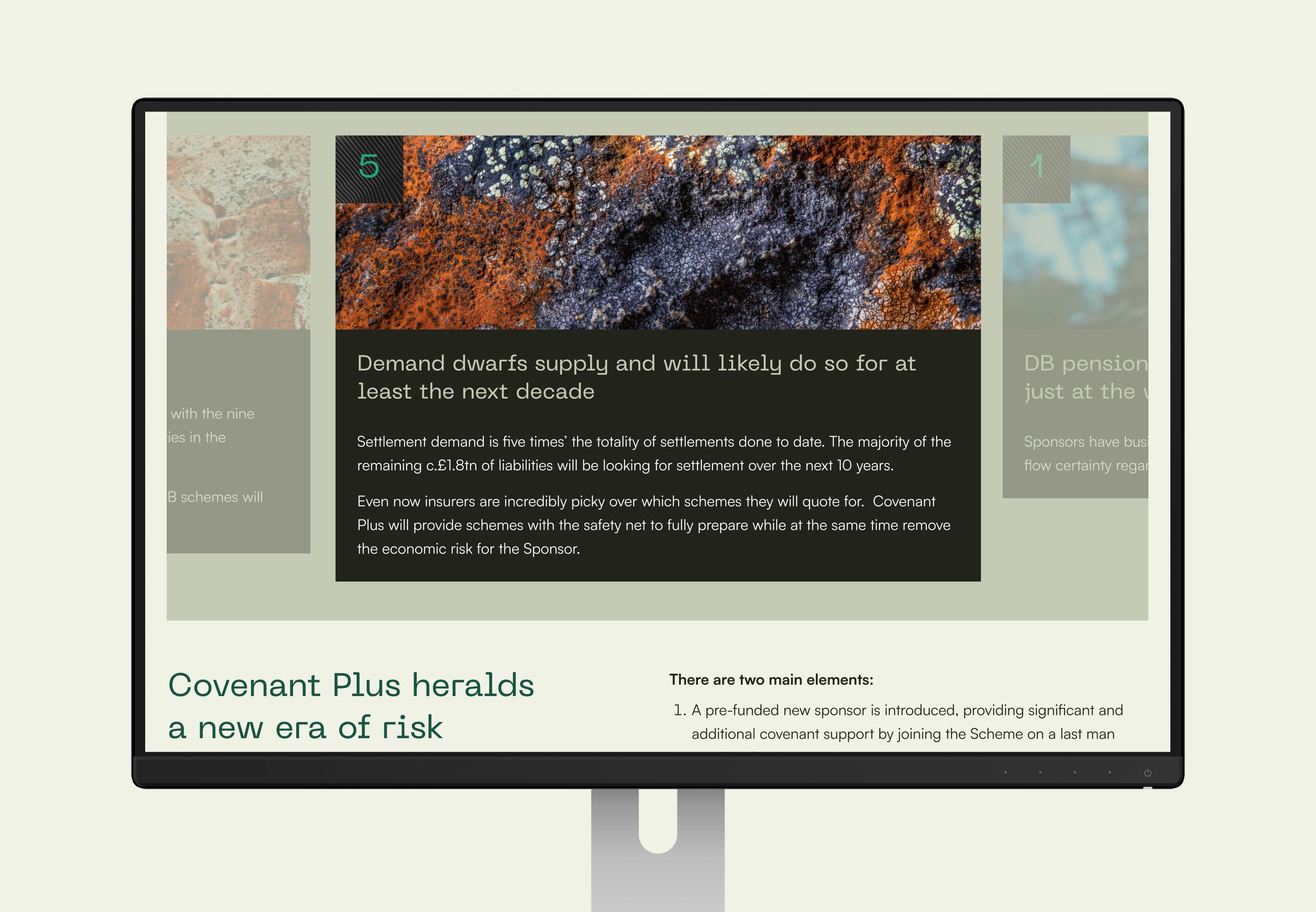

There are more than 5,000 defined benefit (DB) pension schemes in the UK (schemes which pay pension benefits based on salary and length of service) with £1.4tn in assets. Around 9.6 million members are relying on them for their expected retirement income. However, private sector DB schemes are in decline and an estimated £400bn worth of trustees and sponsors are seeking full settlement of member benefits by transferring their assets and liabilities.

But there are challenges in the marketplace. Demand for settlement is surpassing supply. Sponsors (usually the employer), who may be under financial stress, need enough money to fulfil their pension commitments to employees and are looking to remove their financial risk. Trustees, who oversee pension funds’ management, have to safeguard members’ interests even if it means sponsor insolvency. Stakeholders need strategies to navigate this.

PSF Capital’s solution

PSF Capital has launched a new solution to the market, CovenantPlus. This Capital-Backed Funding Arrangement (CBFA) gives DB schemes access to external capital to help them meet their funding and investment objectives, using an agreed strategy and timeframe. It gives sponsors cash-flow certainty and removes risk. It gives trustees a strong covenant, protection from scheme failure and greater security in protecting member’s pension benefits, supporting their end-game strategy.

Our role

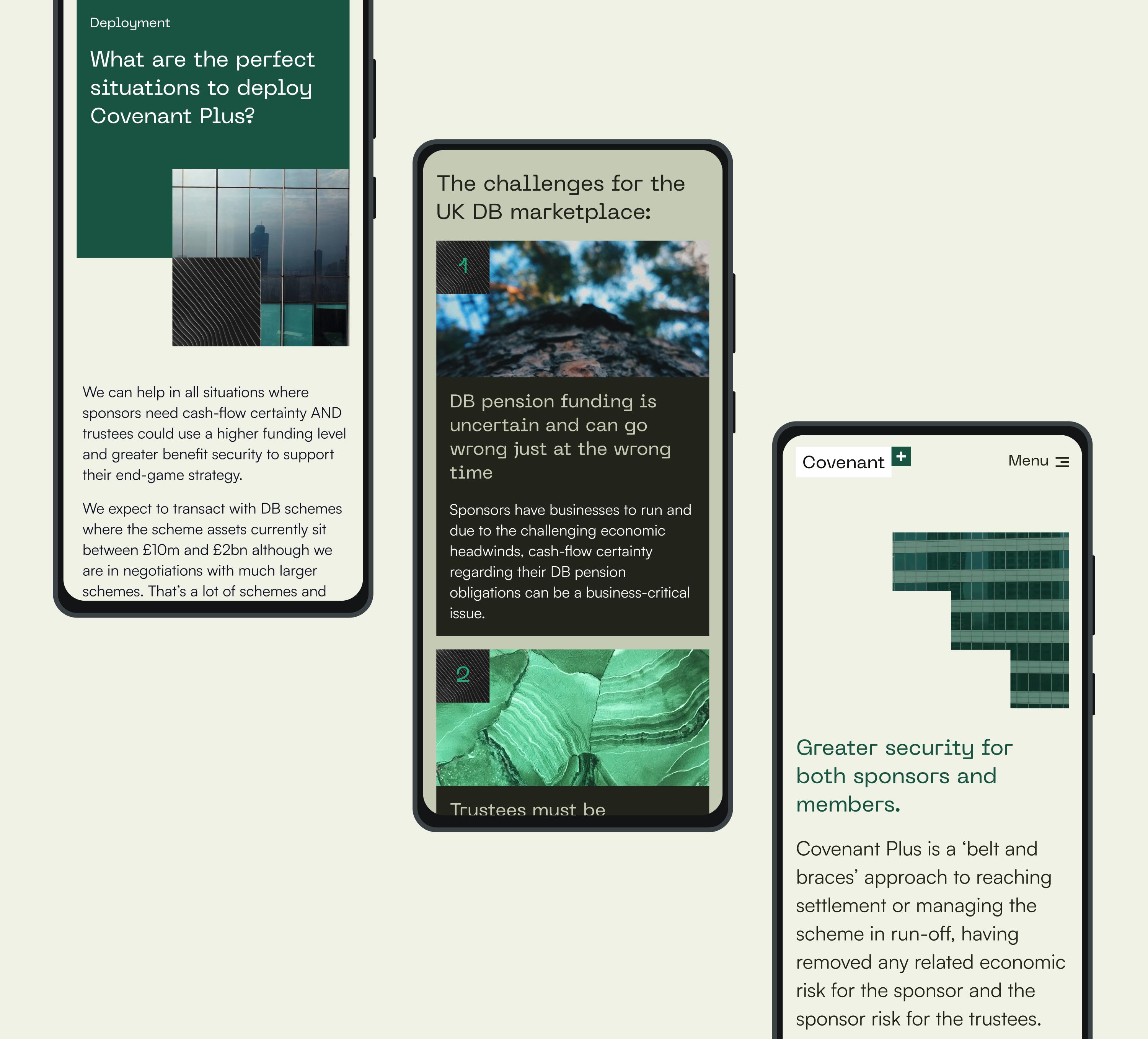

We helped craft and position this new venture including building the brand, establishing a look and feel that best suited the B2B marketplace and crafting a digital presence that would talk to all stakeholders. Our input included client engagement and lead generation through the delivery of a seamless digital experience and gated content.

Working within the finance sector often involves short timeframes were opportunities need to be seized quickly. Our work with Covenant Plus allowed for a 3-month timeframe, where all ideation, content planning, design and development was tackled – allowing for the concept to be realised and released to market quickly.

We created areas of open access content along with locked content to encourage registration and lead gen. Once registered, users were provided access to a data room and case studies showing details of solutions PSF has provided to other schemes.

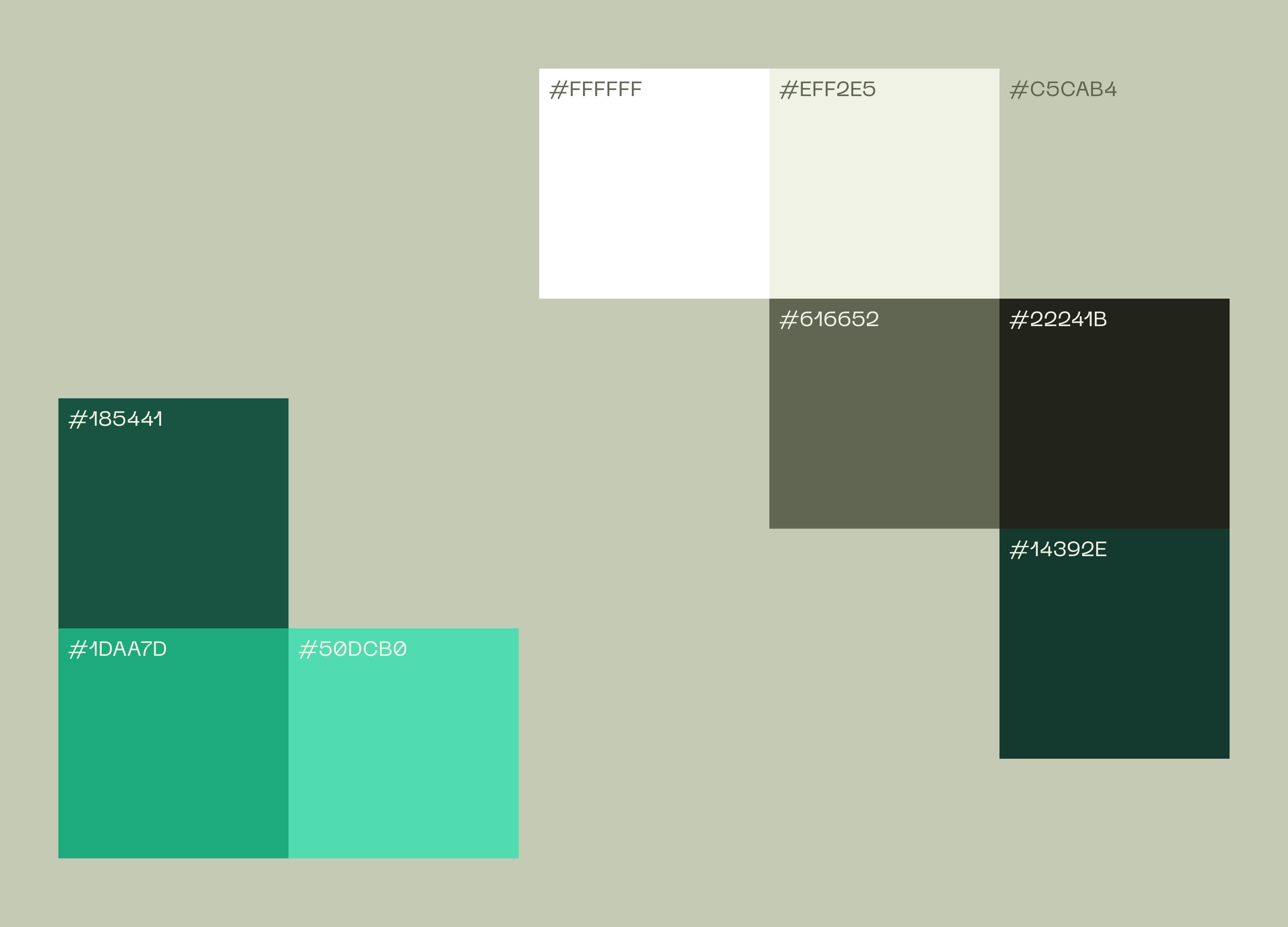

Brand creation

Our visual identity for the brand centres around safety, trust and certainty about the future. To invoke these feelings we’ve used strong architectural images with 90° angles and encased the logo and brand motif in robust holding device. PP Neue Machina is the typeface, chosen for its personality, echoing the straight edges and secure nature of other brand components. We particularly like the detail of the inktraps (where some corners are removed from letterforms) as this gives character to the typeface and is very distinctive for this 'secure' brand.

The outcome

CovenantPlus is a belt-and-braces approach to reaching a settlement or managing a scheme in a run-off period, removing related economic risk for the sponsor and removing the sponsor risk for the trustees. As PSF’s chosen creative partner we helped to launch a venture that manages risk, gives sponsors and trustees more security, and supports a better future for employers and their pension scheme members.